Broader mkts on an upswing; optimism gathers momentum

15-05-2025 12:00:00 AM

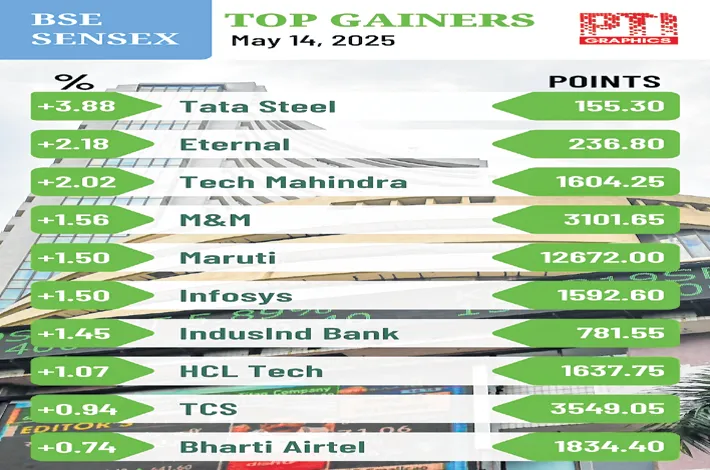

Investor sentiment and market optimism gathered fresh momentum on Wednesday, largely driven by a favourable domestic and global environment. The 30-share BSE Sensex rose 182.34 points to settle at 81,330.56. The gauge hit a high of 81,691.87 and a low of 80,910.03. The NSE Nifty rose 88.55 points to 24,666.90.

“Market optimism is gaining momentum, driven by a significant decline in global and domestic risks. The broader markets are on an upswing as reflected in the Q4 corporate earnings. This has sparked a rally in mid and small-cap stocks, which had underperformed earlier due to premium valuations, earnings downgrades, and moderation in FII and retail inflows. Currently, midcaps are witnessing renewed interest, fuelled by marginal upgrades in recent earnings and the potential for a stronger rebound in FY26. Contributing factors include a consistent decline in inflation, rising disposable incomes, increased government spending, and falling interest rates. Meanwhile, a pause in global trade tensions is boosting sentiment in international markets, with metals gaining traction amid easing concerns over an economic slowdown,” said Vinod Nair, Head of Research, Geojit Investments.

“Global markets are in a state of flux moving up and down in response to continuously changing policy scenarios. Trump’s reciprocal tariff policy which caused tremors in markets, is now done and dusted with a deal emerging between US and China. It appears that the dollar-weakening trend is over. The US 10-year yield has spiked to 4.47% and this might impact the FII fund flows to India which has been keeping the Indian market resilient. There is also a risk of hot money again moving to cheaper Chinese stocks in the new environment of improving US-China relationship,” said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investments.